Concept Capital Group Scam.

In December 2020, a site which we now moderate called Bondreview – LINK wrote an article on Concept Capital Group. The text of that article is copied below, followed by our updated April 2022 article on the activities of this company.

We review Concept Capital’s investment paying 10% per year

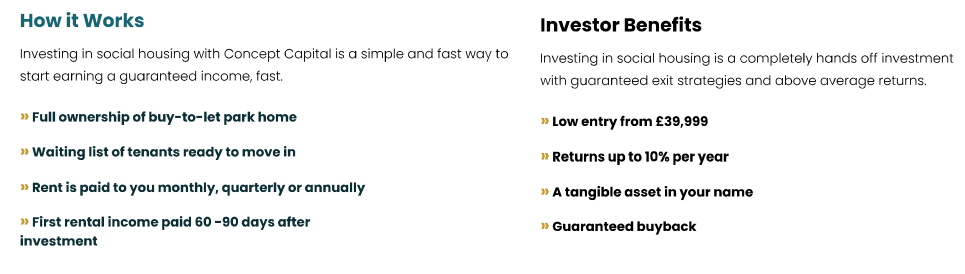

Concept Capital offers an unregulated investment in pre-fab “static homes” paying a “guaranteed” 10% per year.

Investors invest their money to Concept Capital in units of £39,999 (although the website suggests that the minimum investment is £20,000), which is used to buy a static home to be rented to low-income government-supported tenants. Concept Capital “guarantees” to pay the investor 10% per year. Investors’ money is tied up for two years, after which Concept Capital undertakes to buy the static home back from them.

Concept Capital is an FCA-regulated firm, being an appointed representative of What Credit Limited. Its investment opportunity is however unregulated; What Credit (and by extension Concept) is only authorised to offer credit broking and debt counselling and not to run investment schemes.

This is notwithstanding Concept Capital’s claim on its website to be regulated.

Is this a regulated product?

Yes. The unit(s) we provide are regulated by the National Caravan Committee Approval

As an investment scheme Concept Capital is unregulated. The National Caravan Committee does not regulate investment schemes.

The investment is currently being promoted on Facebook by unregulated introducers.

Who are Concept Capital?

Concept Capital Group Ltd is 100% owned by sole director Ian Elliott.

According to his LinkedIn profile, prior to founding Concept Capital, Elliot was a materials manager at a builder’s merchant.

Concept Capital Group Ltd was incorporated in October 2019 and due to its young age is yet to file accounts.

Concept Capital claims the investment has a “6 Year proven track record”, based on a “trial period” run between Social Park Housing (who manages the homes) and Knight Mobile Homes (who manufactures them). The reality is that as an investment opportunity, Concept Capital did not exist before October 2019 at the earliest (when its company and website were registered).

How safe is Concept Capital?

Concept Capital claims to offer “guaranteed return of 10% per annum”, “guaranteed buyback” and “an opportunity to invest ethically and with peace of mind”.

In reality, as with any investment in an unregulated individual company, Concept Capital is an inherently high risk investment with a risk of up to 100% loss.

The guarantee to buy investors’ static homes back is dependent on Concept Capital having the money to do so. Otherwise investors will be trying to sell park homes on the open market. In which case, given that they aren’t going to be offering a 10% per year return, they should expect a significant loss.

The investment literature states that investors will own individual static homes with chassis numbers, but how this squares with the minimum investment of £20,000 being lower than the static home unit cost of £39,999 is not clear. [Update 14.01.21: Concept Capital have told me that for investments of £20,000, Concept Capital bought the other half of the static home. This option is no longer available for new investment.]

Bearing this in mind, should Concept Capital fail to make enough money to pay investors 10% per year on top of their own costs, there is an inherent risk that they will default on their “guarantee” to return the investor’s money in return for the static home.

The worst case scenario is that Concept Capital cannot even supply a static home to the investor and the investor loses up to 100% of their money.

If investors plan to rely on Concept Capital’s “guarantees”, it is essential that they hire professional due diligence specialists (working for themselves, not Concept) to confirm that in the event of a default, the assets of Concept Capital would be valuable and liquid enough to compensate all investors. Investors should not simply rely on what Concept tells them about their assets.

Concept Capital claim to offer a “Diverse Portfolio” on their website on the basis that investors can “Work with our business development team and grow your portfolio holdings”. Investing more money in a single unregulated company, as Concept Capital suggest here, is the exact opposite of diversification.

Regulatory risk

[Update 14.01.21: This section has been amended after contact from Concept Capital – see below.]

My original version of this review flagged the risk that the Financial Conduct Authority deems this to be an unauthorised collective investment, given that if an individual investor’s static home does not pay sufficient returns to pay the investor 10% per year, Concept Capital’s “guarantee” requires it to pay the investor from other resources.

Concept Capital denied they are running a collective investment scheme and told me that the FCA contacted them in November 2020 and, after Concept Capital answered their queries, ended their investigation without taking further action.

Regardless of whether Concept Capital legally qualifies as a collective investment scheme or not, if the FCA has investigated and closed its file, the risk of regulatory action appears to be moot. The FCA has been contacted for comment.

Note that regardless of the FCA apparently giving Concept Capital the green light to continue operating its investment scheme, all the other risks identified in this article still apply.

Should I invest in Concept Capital?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any unregulated investment, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

Any investment paying 10% per year is inherently extremely high risk. As an individual, illiquid security with a risk of total and permanent loss, buying a static home from Concept Capital is much higher risk than a mainstream diversified stockmarket fund.

Before investing investors should ask themselves:

- How would I feel if the investment defaulted and I lost 100% of my money?

- Do I have a sufficiently large portfolio that the loss of 100% of my investment would not damage me financially?

- Have I conducted due diligence to ensure the asset-backed security can be relied on?

If you are looking for a “guaranteed” investment, you should not invest in unregulated investment schemes with an inherent risk of up to 100% loss.

Updated Safe Or Scam Article on the Concept Capital Group Scam – April 2022

We agree with the opinion above, but have spotted a couple of things which weren’t mentioned in the original article.

The original 2019 brochure stated that the investment was a collaboration between three entities. They were Concept Capital Group Ltd, Knight Mobile Homes Ltd (the alleged manufacturer of the mobile homes) and Social Park Housing Ltd (the alleged operator of the mobile home sites). The problem is that Concept Capital Group Ltd had only just been formed in October 2019 i.e no trading history, Knight Mobile Homes Ltd had only just been formed in September 2019 i.e no trading history, and Social Park Housing Ltd had been formed 15 months earlier in June 2018, but had not filed any accounts so its trading history was unknown. As it turns out Social Park Housing filed its first annual accounts covering the period from June 2018 – June 2019 on 5th March 2020. The filing showed that Social Park Housing Ltd was a dormant company in that period and did not trade. We find that quite surprising because the 2019 CCG investment brochure has the following information related to the trading history of Social Park Housing Ltd:

111 Locations Across the UK (Number of sites that have static homes placed by SPH).

362 Static Homes Placed (Number of static homes placed and rented to date of this publication).

307 Active Contracts in the UK.

98% Occupancy Rate.

These figures are entirely fabricated by CCG. SPH did not have these figures. It was a scam. A basic check at Companies House would have revealed this statement in their brochure as being a lie “Social Park Homes and Knight Mobile Homes have been working in conjunction for the past 6 years running a trial period for the proposed new housing concept”. Clearly that cannot be true because the companies only recently came into existence. Furthermore, CCG cannot even get its partner’s name right. It should have said “Social Park Housing Ltd” and not “Social Park Homes Ltd”. There isn’t a company with the name of Social Park Homes Ltd. At the time of writing this article Social Park Housing Ltd only has one director – Simon Christopher O’Donnell. Here is a list of his companies from Companies House – LINK. He seems to have been a director of a number of dissolved mobile home companies and others that are in the process of being dissolved. They were all based at the same address. What is also noticeable is the number of companies where he is recorded as having been a director for only one day. Typically when we see this scenario we often find that the director was appointed on Day 1 and then a year or so later he files a resignation form dated Day 1. In other words, when things go wrong with a company a scammer will back-date his resignation form to make it look like he was not involved. Fortunately Companies House records the day that the resignation form was actually submitted to them and the back-dating will show up. We’re sure there’s nothing untoward regarding Mr O’Donnell, but he does seem to have a forgetful memory because he has submitted long overdue resignation forms in more than one company. We find it very hard to believe that the FCA accepted that this group were not running an unregulated collective investment scheme.

One of the key features of the investment was that the investor could request the group to buy back the mobile home from them at two-yearly intervals. For the first few periods they would allegedly receive full refunds. So here we are two years later and there appears to have been a few director resignations. What a surprise !

The new Concept Capital Group scam brochure has been revamped and now says that the Concept Capital Group has established 300 homes across 112 sites. It looks like 62 homes have disappeared since 2019, but they have added one more site.

The filed accounts of all three companies do not inspire confidence. They don’t have any money. Perhaps that’s because they don’t understand the basics of business i.e buy something at a low price, sell at a higher price. The CCG website offers three types of mobile home. There’s a 1-bedroom home, a 2-bedroom home and a 3-bedroom home. Here is a page from the website where you can buy all of them at the same price of £39,999. Hmmm….. I think I’ll take the 3-bedroom one please.

Buy To Let Properties – CONCEPT CAPITAL GROUP

But, there’s another issue which makes us question their business skills. We were contacted by a mobile home manufacturer who had been approached by the Concept Capital Group scam to provide them with a quote for a 2-bed mobile home (so what’s happened to Knight Mobile Homes all of a sudden – have they quietly slipped away)? Anyway, the price for CCG to buy a 2-bed mobile home was more than £85,000 + vat. Now, I don’t profess to be a great businessman, but buy at £85,000 and sell at £39,999 doesn’t seem to me to be the blueprint for a great business proposition.

Furthermore, the man from CCG wanted the sale to be done through “their Dubai company”. What Dubai company ? There’s no mention of a Dubai company in any of the brochures.

We are wondering whether this is actually a money-laundering operation i.e cleaning up dirty offshore money through seemingly legitimate UK property transactions. Let’s explore that hypothetical theory. There’s no way these homes can be sold for £39,999 so somebody is definitely making up the shortfall. Why would anyone do that ? The brochure says that the home would be in the name of the investor. This would only work for the money-launderer if they bought back the home from the investor in the future (which they can do). Then ownership would transfer to the money-launderer for £39,999. They would own a mobile home which records would show was bought by an investor for £39,999 and was then sold by the investor for the same amount. However, the true value of the property was more than £85,000.

There’s a lot more we could have published, but this should be enough to warn people off this scam investment. If you have bought a mobile home from Concept Capital Group we recommend that you file a report with Action Fraud in the UK. You may be involved in a money-laundering operation.

Concept Capital Group Scam.

You must belogged in to post a comment.