Mayfair Associates Escrow is the latest follow-on fraud to target the unfortunate victims in the StratXMarkets scam. Here is an email sent to investors. # From: Mayfair Associates <[email protected]> Date:…

read moreFurther to our Article published yesterday (click HERE) we are publishing extracts from the Simon Whittley-Ryan response. His response did not specifically address the points in our Article with evidence…

read moreThis article was sent by email to Simon Whittley-Ryan of Avianta Capital Consulting Ltd because it references that company and four other companies he controls. Those companies are Highgrove Osprey…

read moreStratXMarkets was the trading name of an organisation involved in scam binary options trading. It used a series of money mule companies to collect the money. One of those was…

read moreProsperity is a large property developer with at least a dozen developments in the Midlands and North of England. A large group of investors is now involved in an action…

read moreSafe Or Scam has started an investigation into Strategy Markets. Strategy Markets operated a bogus equity and commodity trading platform whereby investors agreed to allow “traders” to buy and sell…

read moreSafe Or Scam has been commissioned to by a group of investors to investigate the activities of Van Gossum Consult. Van Gossum Consult has been operating a bogus trading scheme…

read moreEberhard Cramer Ltd is running a scam operation in the UK. The company has established a clone operation of an existing German company. On its website Eberhard Cramer Ltd claims…

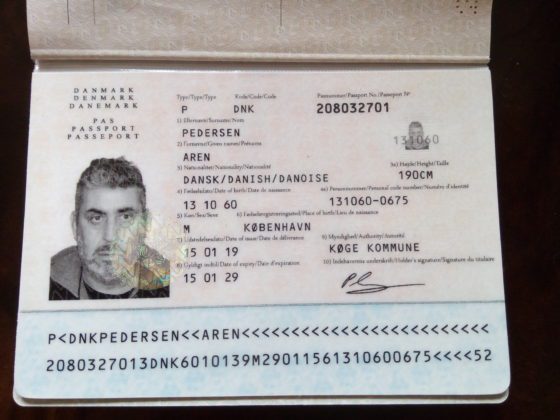

read moreAren Pedersen is the director of a company called Clearline Contracts Ltd. This company is a money mule for a scam involving the bogus purchase of Uber shares, claims made…

read moreMartin Finch was the sole director of Phenco Ltd before it was wound up by the High Court in London on 10th July 2019. He has now been replaced by…

read more- 1

- 2