This article was sent by email to Simon Whittley-Ryan of Avianta Capital Consulting Ltd because it references that company and four other companies he controls. Those companies are Highgrove Osprey…

read moreSafe Or Scam has started an investigation into Strategy Markets. Strategy Markets operated a bogus equity and commodity trading platform whereby investors agreed to allow “traders” to buy and sell…

read moreSafe Or Scam has been commissioned to by a group of investors to investigate the activities of Van Gossum Consult. Van Gossum Consult has been operating a bogus trading scheme…

read moreEberhard Cramer Ltd is running a scam operation in the UK. The company has established a clone operation of an existing German company. On its website Eberhard Cramer Ltd claims…

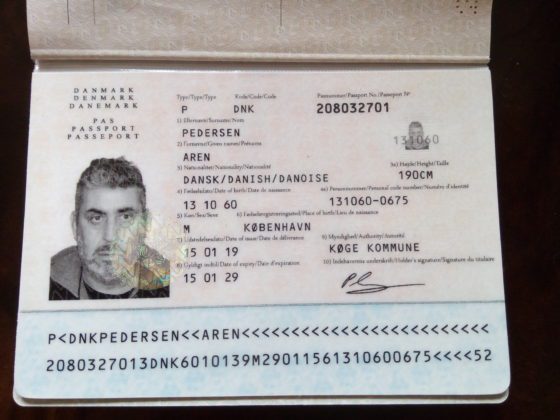

read moreAren Pedersen is the director of a company called Clearline Contracts Ltd. This company is a money mule for a scam involving the bogus purchase of Uber shares, claims made…

read moreMartin Finch was the sole director of Phenco Ltd before it was wound up by the High Court in London on 10th July 2019. He has now been replaced by…

read moreSt John’s Asset Management (“SJAM”) is selling scam investments to the general public. This is not to be confused with St John’s Asset Management Ltd which is a genuine firm…

read moreCarlauren Group sells bedrooms to investors in what it primarily describes as “care facilities” e.g care homes. An associated Carlauren company then rents those rooms back from investors paying an…

read moreOurSpace Partners LP is a Scottish Limited Partnership which raised funds for the OurSpace workspace Ponzi Scheme. A Scottish Limited Partnership (“SLP”) is a structure which contains two types of…

read moreSafe Or Scam, in collaboration with a business recovery and insolvency practitioner firm, and a respected UK law firm, has informed investors in Carlauren Group properties of an action designed…

read more